What is a Mortgage Broker?

WHAT IS A MORTGAGE BROKER?

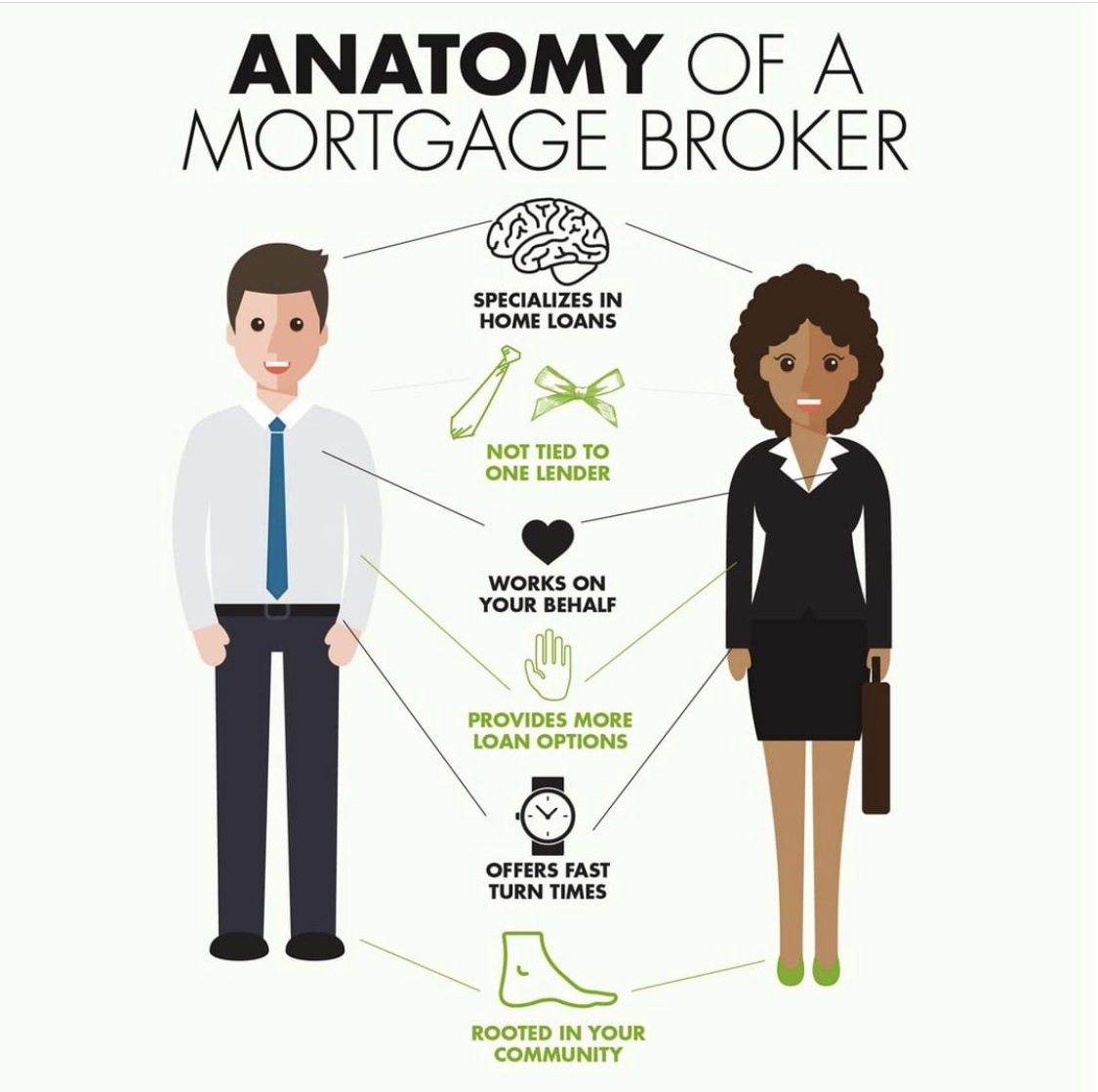

A mortgage broker is a middleman between a homebuyer and mortgage lenders. They work with many different lenders and thus knows how each of their mortgage’s compare. As a buyer, you would provide the mortgage broker with your credit score and financial information and the mortgage broker will find the best lender for you and your financial situation. A mortgage broker will let you know what loan you qualify for and what you can afford. Of course, homebuyers could do this themselves, but it saves a lot of time and hassle to have someone with an insider-view do the legwork for you, especially when you don’t generally have to pay them upfront. Mortgage brokers can also steer individuals away from lenders who have tricky contracts and payment terms. A mortgage broker works between the buyer and the lender throughout the entire loan process. This means they will find the loan that fits a buyer’s needs for the home they want, and whatever the real estate transaction includes, like a home warranty or inspection fees. (Most of the time a home warranty will come with the home through a real estate transaction, however.)

Related:>>Cap Rate: A Must-Have Number for Rental and Commercial Investors

Some buyers with lower credit scores like working with a mortgage broker because they have connections with lenders who will be willing to work with individuals who have less than perfect credit. Other buyers like working with mortgage brokers because they get loan deals from lenders because they have relationships with the lenders. Some mortgage brokers also help homebuyers save money by elimination appraisal and application fees for loans.

WHAT IS THE DIFFERENCE BETWEEN A MORTGAGE BROKER AND A LOAN OFFICER?

Quite simply, a loan officer works for a specific lender and a mortgage broker has regular content with a large amount of lenders to get the best loan for your situation.

A mortgage broker does not originate a mortgage. That means that they don’t write, create or loan the money for a mortgage. A mortgage broker is simply the middleman between the buyer and the lender. A mortgage broker works between the buyer and the bank like a home warranty representative works with the homeowner and the home warranty company. A mortgage broker also works with a variety of different lenders.

A loan officer on the other hand works for one specific lender. If you choose to work with a loan officer they will know how to get you the best deal on a mortgage in their company, but can’t compare those deals with outside of the lending office. A loan officer writes the loans for their lending institution.

Related:>> FREE APPRAISAL ON PROPERTY

HOW IS A MORTGAGE BROKER PAID?

Some buyers are concerned about working with a mortgage broker because they assume they’re being paid based on the cost of the loan they sign. This is not true, and also is illegal thanks to the Dodd-Frank Act. This act states that a mortgage broker cannot be paid from your loan’s interest or for signing a buyer up for a specific lender. Instead, the mortgage broker is paid one to two percent from the loan and is either paid by the buyer or by the institution- not both.

HOW DO YOU CHOOSE THE BEST MORTGAGE BROKER?

There may be some brokers out there who don’t have your best interests at heart. Take your realtor’s recommendations. They will recommend a trusted mortgage broker, home warranty company and inspector.