Investing in Real Estate While Serving in U.S. Military

I have a lot of respect for the men and women in our armed services. Before I continue, if that is you, let my just say a sincere thank you. This guide is meant to serve as a starting place for those looking to invest in real estate while serving in the U.S. military. I want to be 100 percent clear: I’ve never served in the military, so I’m writing this from the perspective of someone who has a pretty good understanding of the U.S. investing world and enjoys explaining things!

U.S. Military

Obviously, there are numerous branches of the military, as well as a variety of jobs, duties, responsibilities, pay scales, and locations for those serving. You might be located within the U.S., or you may be serving abroad. You may have a family, or you may be living alone. Maybe you are full time, or perhaps you are a “weekend warrior.” Maybe you’ve been in the military for years and make a great salary, or maybe you are fresh out of boot camp.

The possibilities are endless, therefore, I will not attempt to say, “This is exactly how you should start investing.” That would be pointless since every investing strategy should be designed around the place where your abilities, finances, and goals meet.

Want more articles like this?

Create an account today to get Divito Real Estate Group best blog articles delivered to your inbox

Related: The Top 8 Real Estate Calculations Every Investor Should Memorize

Instead, this post will attempt to be as general as possible while offering additional resources that you can use to dig in deeper and build your plan based on your specific situation.

The greatest focus of this guide will be on investing in real estate when your location is not guaranteed to remain the same, as this seems to be the greatest hurdle for those looking to invest in real estate while serving in the U.S. military. Although it is helpful to live in the same area you invest, it is not required. And this guide will show you numerous strategies you can use to keep your personal location and your investing strategy separate.

If you have any questions while reading this guide, I invite you to ask me any questions in the comments below this post.

With that, let’s get to the guide.

Why Invest in Real Estate While Serving in the Military?

For all the great things that can be said about Uncle Sam, few would use the word “generous with compensation” to describe our government. I doubt very much that you joined the military to get rich (after all, there is a reason we call it “serving in the military.”) However, if you are like me you probably have hopes, dreams, and ambitions for your family and future that will require more income than you’ll likely make from your career.

While typical personal finance advice is to simply “save more,” it’s not enough to simply save money unless that saved money has a higher purpose. After all, you won’t build wealth until your money is working to earn you money.

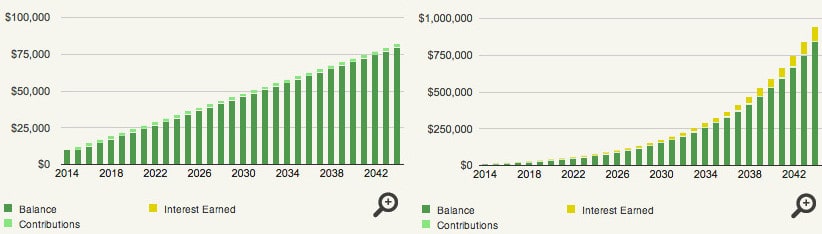

Let me show you two simple charts. The first shows the results of a person starting with $10,000 and saving $200 per month over the course of 30 years. The second graph shows the results of that same person, starting with that same $10,000, and investing that same $200 per month and earning an average of 12 percent each year on their investment.

(Graphs obtained from DaveRamsey.com)

When looking at the graph on the left, the person has a grand total of around $82,000. However, looking at that same $200 per month, but invested at 12 percent, shows a final total of around $940,000 (Also note the scale on the left side of each graph. The left graph goes to a total of $100,000, while the right graph goes to $1 million!)

The difference is astonishing, is it not? A difference of over $855,000 just by investing that money rather than saving. By investing your hard earned money, you can parlay your small investment into far greater amounts later on. Now, clearly no one is arguing that you should simply bury your money in the backyard like the first graph represents. So where is the best place to invest that money?

Obviously, there are a lot of choices. Stocks, mutual funds, index funds, whole life insurance, and more. Ask 10 financial planners what you should invest in, and you’ll likely get 10 different responses (conveniently, those 10 responses will likely correspond perfectly with whatever investment is going to make the planner the highest commission!)

Choosing Real Estate over Other Investing Strategies

However, of all the investments out there, I firmly believe the best is real estate. I believe no other investment on earth offers the same potential for building lasting wealth than real estate investing.

For starters, real estate investing offers:

- The ability to use leverage to maximize your results (applying a small down payment to control a huge asset)

- Historical stability and growth

- Various ways to generate wealth (monthly cash from the rental income, appreciation when prices go up, tax benefits, and more)

- The ability for you to have a direct impact on the results of your investment (unlike other passive investments—like mutual funds—where your financial destiny lies in the hands of unknown employees on Wall Street)

However, real estate is not the same as most other investments either. Real estate requires a certain set of skills and commitment to achieve the incredible results you are looking for. Investing in real estate for great returns takes planning, patience, and knowledge. It takes work.

I believe the end result is worth the effort because of the potential of greater profits. However, the fundamental question exists: Are consistent 12 percent returns possible?

Lucky for you, in the middle of writing this article, I decided to spin off a completely separate article rather than making this post longer than it should be. So to see the answer to this question, and a detailed walk through of exactly how 12 percent can be obtained.

So one final question remains: Is real estate a great investment for those in the military?

I believe yes.

The rest of this guide will show you different strategies you can use to achieve incredible results while keeping your investment passive enough to be location independent from your investments —so you can continue serving your country in the U.S. military or wherever life takes you.

Job vs. Investment

A common problem among those looking to get started with real estate investing involves the confusion between investing in real estate as a job and investing in real estate as an investment. It gets even more confusing because the two are not always easily distinguishable—even to those involved every day in this industry.

Perhaps you’ve seen the TV shows where investors buy a cheap house, fix it up, and sell it, hoping to make massive profits? This practice, known as “house flipping” is very popular and potentially lucrative but is generally considered a “job.” When the “flipper” stops flipping, the money stops as well. An investment, on the other hand, continues to produce income when the producer stops producing.

There is nothing wrong with real estate as a “job,” but I want to encourage you to keep the two separate in your mind. You don’t need to devote 40 hours a week to real estate in order to invest. After all, if you are in the military, you probably don’t have the time!

By focusing on the “investment” side of things, you can build wealth and passive income for your future. The rest of this guide will focus on the “investment side” of real estate, specifically buying and renting single-family or small multifamily properties.

Take Control of Your Finances While in the Military

Before I venture into the actual practices needed to invest in real estate while serving in the military, let me first discuss a very important point: If you don’t have solid control on your personal finances, you have no business investing in real estate.

Real estate is not, despite what the late-night TV gurus may imply, a magic pill to solve your money problems. Money problems start in the heart and soul, so be sure to take steps to fix those before attempting to invest in real estate.

Related: The No. 1 Mistake New Real Estate Investors Make and 4 Ways to Avoid It

If you need help getting a better handle on your personal finances, I invite you to dive into some of these excellent personal finance sites:

- The MilitaryWallet

- From Military to Millionaire

- DaveRamsey.com

- Jeff Rose Financial

- The-Military-Guide.com

Getting Your Education

The first investment you make should not be a property; it should be in your education. As I said earlier, real estate investing is not something to take lightly. Because if you don’t fully understand what you’re taking on, you could lose a lot of money.

However, I’m not referring to the “late-night, big hair, big promises” salesmen who offer courses for tens of thousands of dollars. I believe information has been democratized with the explosion of the internet, and you can learn nearly everything you need from free sources like Divito Real Estate Group.

How Should You Invest While in the Military?

As mentioned previously, there are numerous ways to invest in real estate. I think it’s important to understand a few different strategies so you can best determine what fits in your lifestyle. Allow me to share a few of the most common strategies used by those in the military.

1. Owner-Occupant Investing

Chances are you’ve heard of the VA loan. One of the coolest benefits for active and former U.S. Military members, the VA loan is a subsidy (well, it’s technically loan insurance for the bank, but that’s not important to know right now) provided by the government that can help you obtain a home mortgage with no money down. Yep, zero percent down. You can even get the seller to pay most of the closing costs, so you can get into a property with almost nothing out of pocket.

But what does buying an owner-occupied house have to do with investing? After all, a house isn’t really much of an investment. (At least, not in the conventional sense. Yes, the price could go up, but that’s only an assumption.) However, there are two common situations which can turn a homeowner into an investor:

Home to Rental: Many U.S. Military members find themselves moving…a lot. For a variety of reasons, you and your family may find yourself at a number of different bases in the U.S. while you are not serving overseas. Therefore, many military families become real estate investing families almost by accident, by simply turning their existing home into a rental each time they move.

Small Multifamily: A small multifamily property can be either a duplex, triplex, or fourplex. And most loans, including the VA loan, consider these properties to be the same as a single-family house. In other words, you can live in one unit and rent the other unit(s) out to cover the mortgage payment or more.

Both of these strategies can be used by members of the military (or anyone, really) to get started investing with almost no money down. To learn more about this strategy, be sure to check out How to Use a VA Loan to Purchase Investment Property from VeteransUnited.com as well as my article, House Hacking: A Beginners Guide to Hack Your Housing and Live for Free.

2. Turnkey

One of the most popular options for investing in real estate while maintaining location independence is through a “turnkey” real estate company (aka “turnkey”). Although there are differences in how each company operates, they all exist to provide a “one-stop shop” for buying and leasing residential real estate. In other words, they can find the property for you, help you obtain financing, manage the tenants, and take care of most of the bookkeeping.

Sound too good to be true?

There is a lot of debate on the effectiveness of a turnkey real estate company, which is usually based on individual experiences with certain turnkey providers. Obviously, the turnkey company needs to make a profit, so you may pay a higher premium for the property than you might otherwise pay on your own.

On the other hand, turnkey companies tend to negotiate better deals because they are trained to understand their market, and their business model is tied to repeat customers and successful investments for their clients.

Related: 43 Things That Significantly Upgrade Home For Less Than $35 On Amazon

If you plan to keep things simple and go with a turnkey provider, don’t use it as an excuse not to do your homework. You should still evaluate the numbers the same as if you were doing it all on your own. Never simply accept what the turnkey provider says as gospel truth. Have trust—but verify everything.

Also, interview several turnkey companies to see which will make the best fit for you. Ask for references and actually call those references. This turnkey company will largely be responsible for the success of your investment, so treat it like a business and do your due diligence.

Turnkey investing can be incredibly helpful for someone looking to invest in real estate while in the military, but carefully weigh the options and analyze each deal for yourself to make sure you are getting a great investment property.

3. DIY Rentals

If turnkey rentals are not your thing, you can always choose to “do it yourself” and simply invest in real estate from a distance. You can choose a location, do your homework from a distance, sift through properties online, interview property managers over the phone, hire a property inspector to check out the property, arrange financing, and sign the papers…all without ever stepping foot in the same state (or country) as the property.

The largest drawback to this kind of investing is simply not knowing the neighborhoods. You’ve heard the old cliche that real estate is all about “location, location, location.” And this is especially true with rental property investing.

Online, most properties look amazing because the real estate agent listing the property has a fiduciary responsibility to present the property in the best light. In other words, the listing is not going to mention that the property is in a food desert, on a busy street that cars speed down, or is sandwiched between two houses with equally noisy neighbors. Therefore, if you plan to “DIY” it and invest in real estate while living out of the area, here are a few helpful tips:

a.) Try to Visit: If at all possible, try to take a vacation to this area to see firsthand what you are getting into. Make as many connections as possible and tour as many properties as you can so you can get a good feel for the area.

b.) Build Your Team: You don’t need to be physically present if you can build a strong enough team on the ground. This team should consist of, at a minimum, a great real estate agent (preferably an investor-friendly agent,) a property manager, and a property inspector. Additionally, if you can build relationships with active Divito Real Estate Group members in that area, you will have a fantastic source of information and contacts. This will be invaluable to you as you begin investing in a new area.

c.) Use the Internet: The internet is an amazing thing, isn’t it? In just minutes, you can discover the crime statistics of any neighborhood in the country, as well as virtually drive down any major road in the U.S. via Google Street View. Utilize online tools to make sure you know the neighborhood you are investing in.

If you plan to DIY it, I highly encourage you to really dig into your education before you do. I know a lot of experienced investors who won’t invest this way because the risk is too high—so be sure you fully understand what you are getting yourself into. However, when you do your homework and invest intelligently, investing in rental properties the DIY way can be lucrative.

4. Partner Up

If you want to get started investing—but don’t have the time or knowledge to do the previous methods outlined in this guide—you may consider partnering with an experienced investor who can help you put your money to work.

You see, as a member of the armed services, you have a valuable trait: You are employed. In other words, you probably have the ability to obtain mortgages and may even have a bit of cash saved up. While you may lack the location-aspect of putting together a deal, there may be another investor out there who has the location but lacks the cash, credit, or job history.

Great partnerships bring together multiple parties with different strengths to accomplish goals that they could not do alone. Look at what traits you have. What can you bring to the table?

5. Crowdfunding

This is a recent phenomenon in the real estate investing space. Crowdfunding is the process of bringing together hundreds of investors to invest in real estate together. Several portals, such as RealtyMogul or Fundrise, have gained traction as profitable, yet passive, methods for investing in real estate without needing to get your hands dirty.

As of this writing, crowdfunding is a relatively new addition to the real estate world, so the rules are still a bit fuzzy on where the industry is headed (and what exactly is legal to do). But society does seem to be moving to allow more and more crowdfunded deals.

6. Notes

Finally, one more avenue that you may want to consider if you find yourself with some extra cash is through notes (mortgages.) Typically, when you buy a home, you sign a “note” with the bank. This note states that you will pay a certain interest rate for a certain time period. However, what many people don’t know is that you can buy and sell these notes just like properties.

Conclusion

You do not need to live and invest in the same location, which is great news for those investing while serving in the military. Yes, it helps; but with a solid plan, a good team, and proper education long distance real estate investing can produce a great future for you and your family.

If you are serving in the military, it is my hope that this post has served you in some small fashion and has given you a starting place to begin investing in real estate while stationed overseas or at home. As I mentioned above, I encourage you to ask any questions you want, either here or in the Forums. And we’ll do our best to help you out and get you on your way to a positive real estate investing experience.

Once again, thank you for your service to our country. If there is any way BiggerPockets can help you succeed, don’t be afraid to ask.