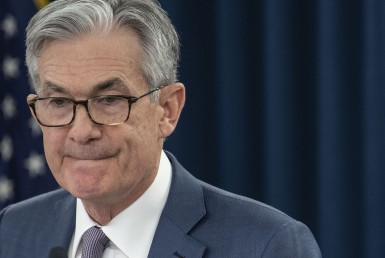

On Thursday, President Donald Trump signed legislation rolling back some of the lending restrictions enacted in response to the housing boom and bust. While the new law doesn’t entirely do away with those financial reforms, it does have some significant implications for home buyers.

The Dodd-Frank Wall Street Reform and Consumer Protection Act imposed stricter rules around lending for both borrowers and lenders, in an attempt to shut down the careless mortgage lending that laid the groundwork for the housing crash. Critics, however, have said that these stricter rules have made it too difficult for anyone to get a loan, hobbling the real estate market.

The new law aims to open up access to credit by loosening regulations on small- and medium-size banks. Since the new law doesn’t change the rules for the largest banks, it shouldn’t make the financial system much riskier than it is now. Here’s what home buyers should know:

1. Alternative credit-scoring models could help those without traditional credit files

The reform law encourages Fannie Mae and Freddie Mac to explore alternative credit score models. Research shows that 26 million American adults don’t have credit history with one of the three nationwide credit-reporting companies and that black, Hispanic, and low-income consumers are more likely to be part of this “credit invisible” group. New models could use data left out of current models, such as rent payments, that might help lenders evaluate the creditworthiness of more would-be borrowers.